Import staff social insurance · tax information

【For administrators】

Here is the introduction of the procedure to import social insurance / tax information settings for employee with CSV file * 1.

You can set up more than one person at a time. Import employee salary information

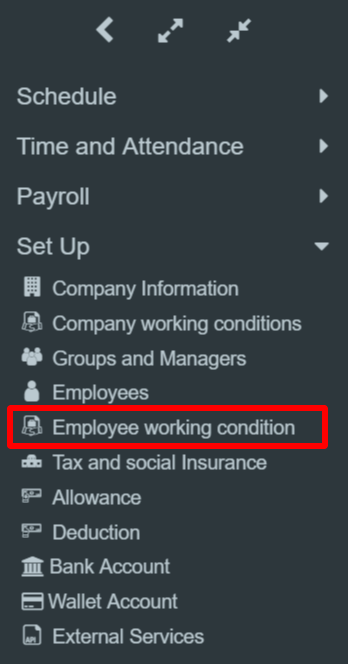

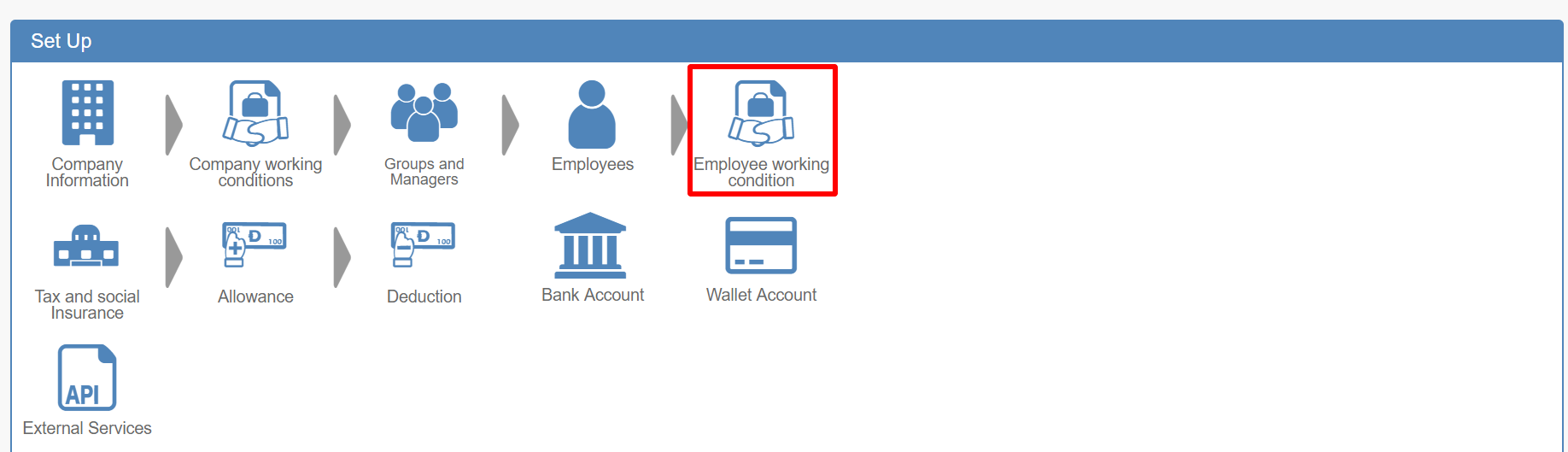

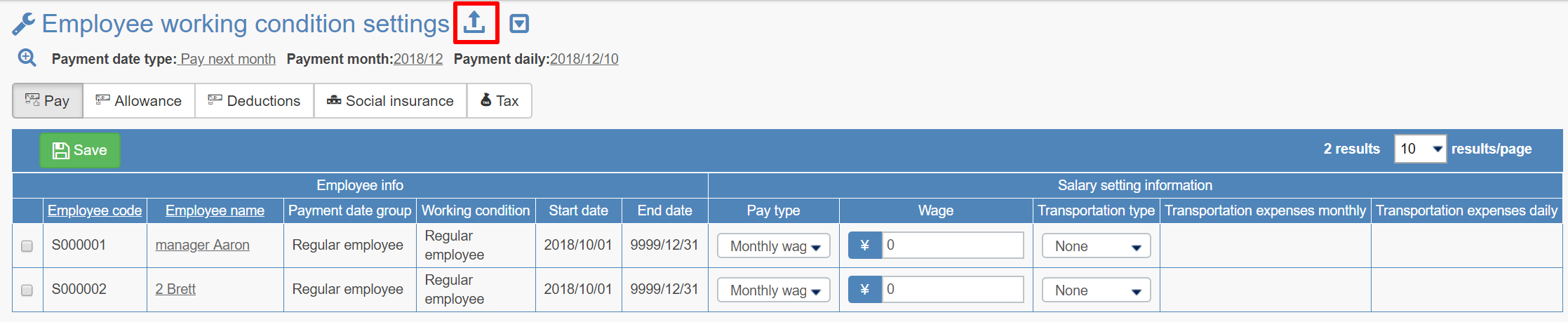

- Click employee working conditions

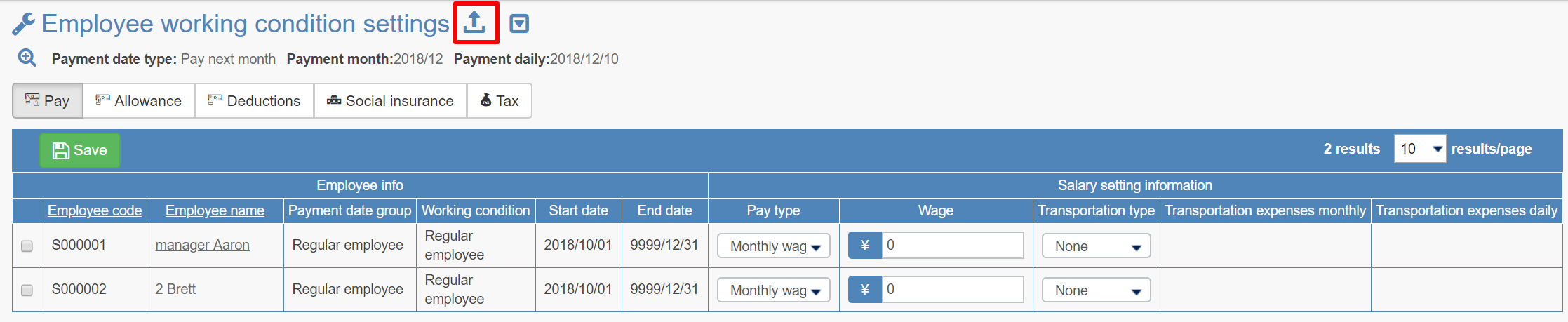

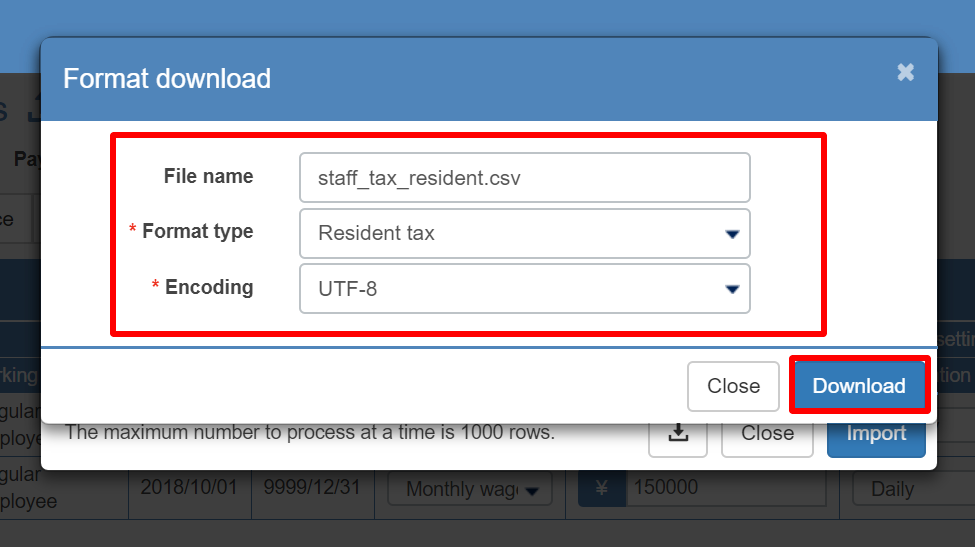

- Click the↑ icon, click on the format download

- Select file name, format type, encoding * 2, and click Download.

Please select format type from "Resident's tax" or "Social insurance, Income tax (Japan, Vietnam, India)".

By default, encoding is set to SJIS if the language setting is Japanese, and UTF-8 for cases other than Japanese.

- Start entering the data on downloaded file.

The first to fourth lines of the file are as follows.

Please enter the data to be imported from line 5.

Save the created data with the file type (CSV comma separated).

line 1 Types of data

line 2 The number of characters and type of characters of data that can be registered

line 3 Data sample

line 4 Whether if the field is required or not

【Social insurance, income tax classification】Employee code(Required) Enter Employee code(Up to 15 half-width alphanumeric characters) Effective date(Required) Enter the year and month you want to reflect in the salary information

* Set based on the payment date. It depends on when you want to reflect from salary to be paid.

YYYY/MMInput in the form of a half-width number

example)2018/04Basic pension number Enter basic pension number (half size number)

※ Please do not put hyphen (-).Registration classification Enter social insurance registration classification (Half-width numeric)

1:Get qualification 2:Loss of qualification 3:Article 118 (1) of the Health Insurance Law 4:Article 118 (1) of the Health Insurance Act Not applicable 5:OtherInsurance number Enter Insured Personnel Number (Half-width numeric) Date of occurrence Enter the date of registration on social insurance in YYYY / M / D format (Half-width code)

example)2018/4/1Registration reason Register to Social Insurance Enter the cause cause occurrence (up to 255 letters) Acquisition classification Enter social insurance acquisition classification (Half-width alphanumeric characters)

1:新1 2:再2 3:共3 4:船4Loss of qualification reason If you lose social insurance qualification, enter the reason (half-width numeric)

1:Other 2:death 3:70 years old 4:Reached 75 years old 5:Certification of disabilityHealth insurance target(Required) Enter if you are interested in health insurance (half-width)

0:Non-target 1:objectHealth insurance issue date Enter the date of acquisition of health insurance in the form of YYYY / M / D (Half-width code)

example)2018/4/1Health insurance expire date Enter the loss date of health insurance in the form of YYYY / M / D (Half-width code)

example)2018/4/1Health insurance insurance number Enter health insurance's insurance number (half width) Health insurance insurance fee Enter health insurance premium (half-width numeric) Care insurance target(Required) Enter if you are interested in nursing care insurance (half-width)

0:Non-target 1:objectCare insurance issue date Enter the start date of nursing-care insurance in the form of YYYY / M / D (Half size code)

example)2018/4/1Care insurance expiry date Enter the end date of nursing-care insurance in the form of YYYY / M / D (half-width numeric)

example)2018/4/1Care insurance fee Enter insurance premiums for long-term care insurance (Half-width numerals) Welfare insurance target(Required) Enter if you are eligible for Employees' Pension Insurance (Half-width)

0:Non-target 1:objectWelfare insurance type Enter the division of Employee's Pension Insurance (Half-width number)

1:General 2:Underground members, sailorsWelfare insurance number Enter the welfare pension insurance number (single-byte number) Welfare insurance issue date Enter the number of the acquisition date of the welfare pension insurance in the form of YYYY / M / D (single-byte number)

example)2018/4/1Welfare insurance expire_date Enter the number of years of welfare pension insurance loss in YYYY / M / D format (Half-width code)

example)2018/4/1Employment insurance target(Required) Input whether or not the subject of employment insurance(Half size code)

0:Non-target 1:objectEmployment insurance issue date Enter the acquisition date of employment insurance in the form of YYYY / M / D(Half-width code)

example)2018/4/1Employment insurance expire date Enter the date of loss of employment insurance in the form of YYYY / M / D(Half-width code)

example)2018/4/1Employment insurance number Enter Employment Insurance Number(Half-width code)

※ Please do not put hyphen (-).Accident insurance target(Required) Enter whether it is subject to workers' compensation insurance(Half-width code)

0:Non-target 1:objectIncome tax amount division(Required) Enter the division of Income Tax of Income Tax(Half-width code)

1:A 2:B 3:CNumber of dependents In the case of "A" classification of income tax, enter the number of dependents dependent(Half-width code) Residence tax target(Required) Enter whether it is subject to residence tax(Half-width code)

0:Non-target 1:objectResidence tax year To collect residence tax, enter year(Half-width code)

example)2018 → 2018Residence tax for 6 Enter the residents tax in June(Half-width code) Residence tax for 7 Enter the residents tax in July(Half-width code) Residence tax for 8 Enter the residents tax in August(Half-width code) Residence tax for 9 Enter the residents tax in September(Half-width code) Residence tax for 10 Enter the residents tax in October(Half-width code) Residence tax for 11 Enter the residents tax in November(Half-width code) Residence tax for 12 Enter the residents tax in December(Half-width code) Residence tax for 1 Enter the residents tax of January of the following yearを入力(Half-width code) Residence tax for 2 Enter the residents tax of February of the following year(Half-width code) Residence tax for 3 Enter the residents tax of March of the following year(Half-width code) Residence tax for 4 Enter the residents tax of April of the following year(Half-width code) Residence tax for 5 Enter the residents tax of April of the following year(Half-width code) Welfare pension insurance fund target(Required) Enter whether it is target(Half-width code)

0:Non-target 1:objectWelfare pension insurance fund number Enter Welfare Pension Fund Fund Number(Half size code) Welfare pension insurance fund join date Enter the subscription date of the employee pension fund in the form of YYYY / M / D(Half-width code)

example)2018/4/1Welfare pension insurance fund leave date Enter the leave date of the employee pension fund in the form of YYYY / M / D(Half-width code)

example)2018/4/1

【Residence tax】Employee code(Required) Employee code(Until 15 characters) Residence tax target(Required) Enter whether it is subject to residence tax(Half-width code)

0:Non-target 1:objectResidence tax year To collect residence tax, enter year(Half-width code)

example)2018年 → 2018Residence tax for 6 Enter the residents tax in June(Half-width code) Residence tax for 7 Enter the residents tax in July(Half-width code) Residence tax for 8 Enter the residents tax in August(Half-width code) Residence tax for 9 Enter the residents tax in September(Half-width code) Residence tax for 10 Enter the residents tax in October(Half-width code) Residence tax for 11 Enter the residents tax in November(Half-width code) Residence tax for 12 Enter the residents tax in December(Half-width code) Residence tax for 1 Enter the residents tax of January of the following yearを入力(Half-width code) Residence tax for 2 Enter the residents tax of February of the following year(Half-width code) Residence tax for 3 Enter the residents tax of March of the following year(Half-width code) Residence tax for 4 Enter the residents tax of April of the following year(Half-width code) Residence tax for 5 Enter the residents tax of April of the following year(Half-width code)

【CSV file sample】.png)

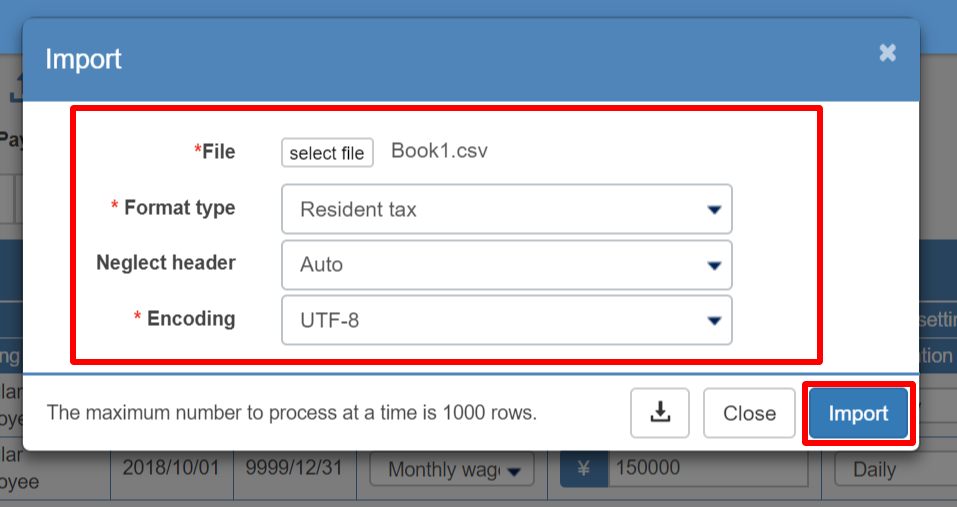

- Import the data.

↑ icon: click on import

- Select file, encoding and click Import

- Select file

Please select the CSV file created in 4. - Select encoding

Please select the same format as downloaded at 3.

- Select file

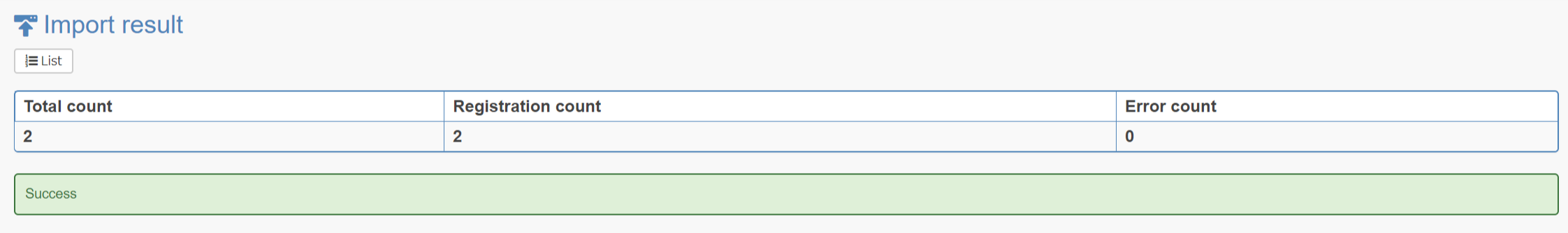

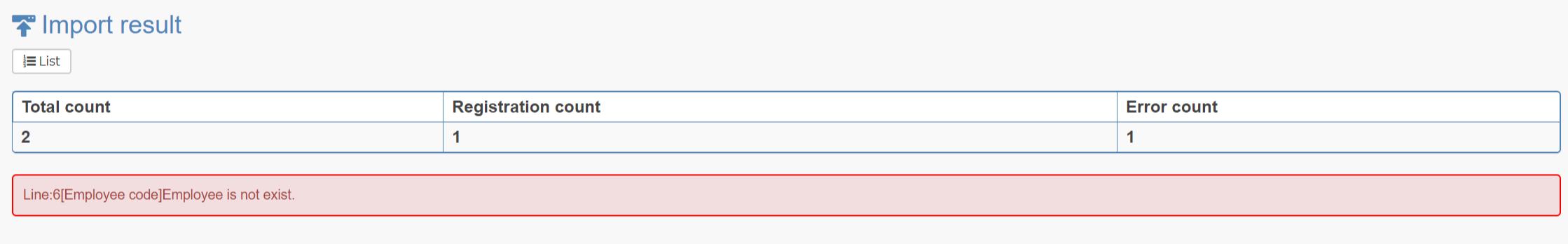

- The import result is displayed.

If it fails, follow the error message and try again.

* 1 CSV file

CSV is an abbreviation of Comma Separated Value, and is a file of Separated (delimited) Value (value) in Comma.

It is also called a comma-separated file. To handle this file, spreadsheet software such as Microsoft Office Excel and text editor such as memo pad are necessary.

* 2 Encoding

Converting data according to certain rules. SJIS and UTF-8 correspond to the encoding of CSV file.

【SJIS】 It is a character code made for Japanese. It is widely used in files on PC. [UTF - 8] It is a universal character code. You can display almost any PC environment.

Although both are common, there is a possibility of garbled characters depending on your environment. If you get garbled characters, please try it with a different encoding.