Income tax on allowance / deduction About social insurance premium target

【For administrators】

This is about "income tax calculation" "social insurance calculation" etc.

in the setting of allowance and deduction master.

Setting allowance master

When paying allowance separately from basic salary, please check whether it will be "taxable", "subjected to social insurance calculation", "include in extra wage unit" or " include in average wage calculation" .

.png)

Included in calculation of income tax (taxable)

Check if you want to pay taxes on the allowance.

Taxable Allowance.

- Job allowance, regional allowance, family (allowance) allowance, housing allowance etc.

Allowance not subjected to income tax.

- Commuter allowance of less than a certain amount.

* For tax exemption limit of commuting allowance, please check the website of the National Tax Agency in Japan.

Japan National Tax Agency - Travel expenses for relocation or business trips are those normally recognized as necessary.

- Of allowances for duty and daily staff, those less than a fixed amount.

※Please also check the article of the National Tax Agency of Japan.

Japan National Tax Agency(Salary income tax)- Job allowance, regional allowance, family (allowance) allowance, housing allowance etc.

Include in social insurance premium calculation (standard remuneration monthly)

Please check if you include in social insurance fee calculation.

Various allowances other than basic salary are subject to social insurance fee calculation (standard compensation monthly fee).

Basically all of basic salary, allowance etc received as compensation for labor will be subjected.Social insurance premium calculation allowance (included in standard monthly remuneration)

- Job allowance, regional allowance, family (support) allowance etc.

- In-kind salary paid for things other than currency, such as meal, housing, clothing etc.

Allowance not included in social insurance premium calculation (not included in standard monthly remuneration)

- Things that are not subject to labor (sympathy money, celebration etc.)

- Things to be temporarily received (Full house bonus, business trip expenses)

- Bonuses paid up to three times a year

Commuting allowance is tax exempted from income tax but subjected to social insurance calculation, so it should be included in a standard monthly remuneration.

* For items that are paid in kind, they are converted into currency based on the standard price set by the Minister of Health, Labor and Welfare, and are included in the remuneration.

Japan Pension Service- Job allowance, regional allowance, family (support) allowance etc.

Include in basic calculation of premium wage unit price

Please check this when you want to include this allowance in extra wage unit price calculation.

The premium unit price is calculated by the following formula.- Monthly salary

Premium unit price = Total monthly wage*1 ÷ Number of hours worked (average) per month*2 - Hourly wage

Premium unit price = Hourly wage + Monthly allowance ÷ Number of hours worked (average) per month*2

*1 The allowances that can be excluded from the total wage are the following seven.

The following allowances can be excluded because they are not directly related to labor and are paid based on personal circumstances.

* Not all exemptions stated here can be excluded. Please also check materials of the Ministry of Health, Labor and Welfare.

Ministry of Health, Labor and Welfare- Family allowance

- Commuting allowance

- Separable allowance

- Child's education allowance

- Housing allowance

- Wages paid temporarily (marriage allowance, personal injury and sickness allowance etc.)

- Wages paid every period exceeding one month (bonus etc.)

*2 You can choose whether to set the (average) prescribed number of hours worked per month as a 12-month average or a prescribed working hours for each month.

Set Premium applicable for allowance- Monthly salary

Include in calculation of average wage

Please check if you want to include it in total wage when calculating average wages.

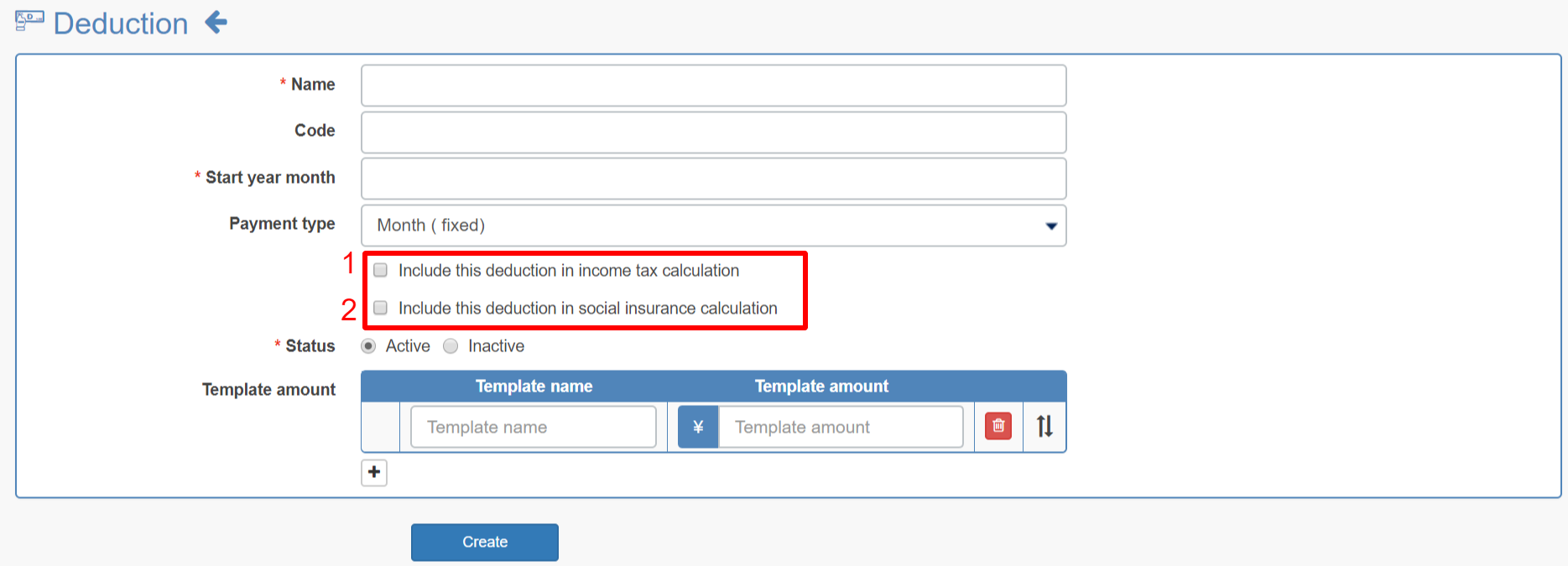

Deduction

Also in the setting of the deduction master, choose whether to include in the income tax calculation or social insurance calculation.

Include this deduction in income tax calculation

The amount subtracting the deductible amount is subject to taxation.

Example) Basic pay and deduction A only

Include deduction A in income tax calculation (when ticking the box)

Taxable amount = Basic salary - Deduction A

Do not include deduction A in income tax calculation (when not ticking the box)

Taxable amount = Basic salaryInclude this deduction in social insurance calculation

The amount subtracting the deductible amount will be subjected to social insurance fee calculation.

Example) Basic pay and deduction B only

Include deduction B in social insurance amount calculation (when ticking the box)

Social insurance calculation = Basic salary - Deduction B

Do not include deduction B in social insurance amount calculation (when not ticking the box)

Social insurance calculation = Basic salary

* In the payroll calculation, it affects the calculation of employment insurance fees and workers' compensation insurance fees out of social insurance premiums.

Health insurance premiums, nursing care insurance premiums, and welfare pension insurance premiums are set by standard monthly remuneration.

Register social insurance bank account of staff