Register deduction master

【For administrators】

Set your own deduction

Types of deduction

Deductions will be made according to the working conditions of the target employee or employee working conditions.

The way of deduction will change according to the classification, so please check how you want to deduct and set the classification.

| Payment type | Frequency | Amount of money | Where to input | Description |

| Month (fixed) | Every month | Fixed | - | Fixed amount will be deducted every month. |

| Month (input) | Every month | Flexible | Payslips menu | Use it monthly if the amount of deduction fluctuates, or it should not be deducted every month. Enter the amount in the Payslips menu. |

| Number of Service | Every work | Flexible |

Timesheets menu | Set the deduction amount per one time, and input the number of times you want to deduct. It is calculated by times × unit price. |

| Working hours | Working time | Flexible |

- | Select the time item to be targeted. It is calculated by time x unit price. |

| Work (input) | Every work | Flexible |

Timesheets menu | Input the amount on the day you want to set deductions. |

①Create deduction master

In the deduction master, you can register the unit price table (* 1).

The registered unit price table can be selected when setting deduction with working conditions (employee working condition).

You can also register new deductions in ② and ③ below, a unit price table can be made only at the deduction master menu.

②Set allowance deductions on working conditions

When you want to deduct the certain amount of money from employee sharing same working condition, assign the deduction item from the working condition.

The price can be selected from the unit price table registered with the deduction master of ①.

Even if you do not use the unit price table, you can still create new deductions in working conditions.

③Set employee working conditions

When you wan to deduct the amount of money from each employee with different items, it is better to assign the deduction from the employee working condition.

The price can be selected from the unit price table registered with the deduction master of ①.

Even if you do not use the unit price table, you can still create new deductions in working conditions.

④Where to enter allowances / deductions

There are deductions that are automatically calculated if you set deductions under working conditions (Employee labor conditions), and deductions that you need to manually enter from the designated screen.

For items which ''Where to put'' column are blank in the above table, the deduction amount is automatically calculated when set by working conditions (employee working conditions).

(※1)Unit price table

If there are several patterns of deductible amount for a deduction, it is convenient to register the amount pattern at the deduction master registration in ①.

Example) Life insurance premium: premium ① 10,000, premium ② 5,000

* Deductions newly registered on any of the above screens ①, ②, ③ are automatically reflected in the deduction master and can be selected from other screens.

Create deduction master

- Click on Allowances and Deductions.

.png)

.png)

- Open Deduction tab and click on +icon.

.png)

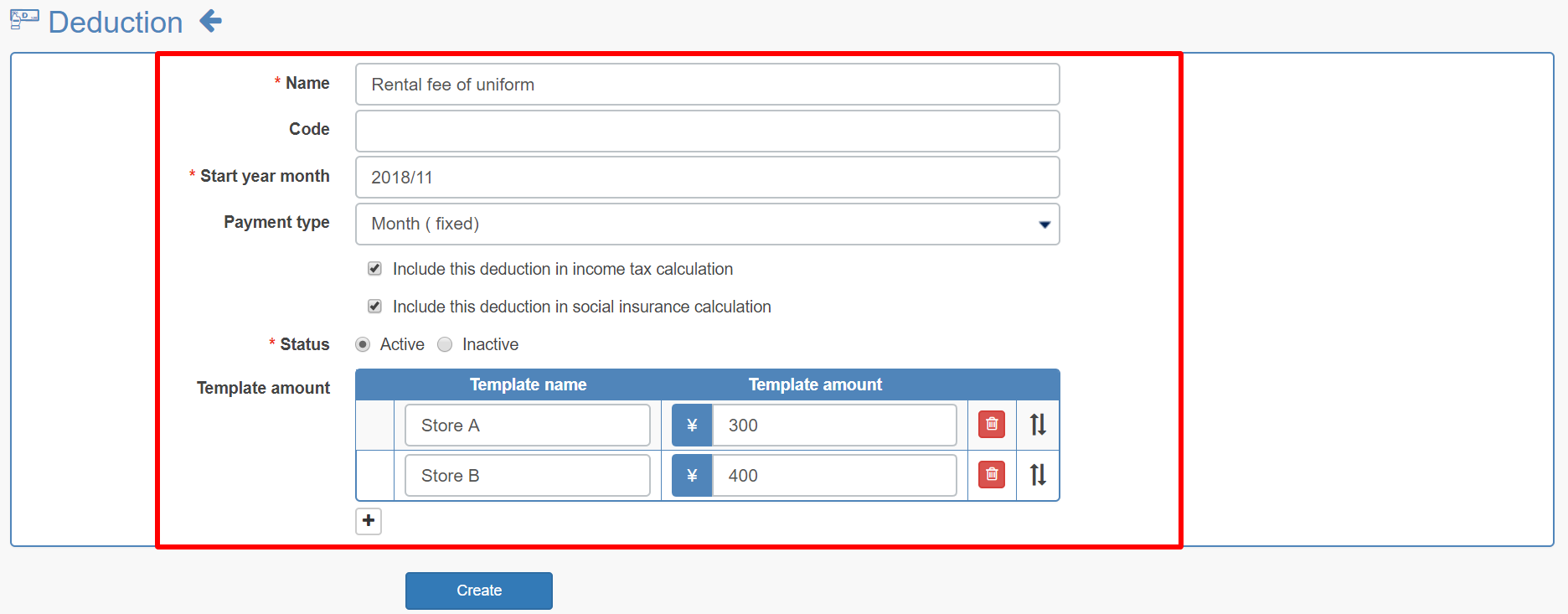

- Enter the detail of deduction and click on Create.

- Name: Enter the name of the deduction item.

- Code: Input is optional.

- Start year month: Set the date to use this item.

- Payment type: Select the method of deduction. Please refer to the table below.

Payment type Frequency Amount of money Where to input Description Month (fixed) Every month Fixing - Fixed amount will be deducted every month. Month (input) Every month Flexible Payslips menu Use it monthly if the amount of deduction fluctuates, or it should not be deducted every month.

Enter the amount in the Payslips menu.Service number Every work Flexible Timesheets menu Set the deduction amount per one time, and input the number of times you want to deduct.

It is calculated by times × unit price.Working hours Working time Flexible - Select the time item to be targeted.

It is calculated by time x unit price.Work (input) Every work Flexible Timesheets menu Input the amount on the day you want to set deductions.

※Where to enter allowances / deductions - We will set whether to include deduction in income tax calculation, social insurance fee calculation.

Income tax on allowance / deduction about social insurance premium - Status: Please deactivate it if you no longer use it.

- Template amount: When setting a unit price pattern, please register the name and amount.

If the classification is "Month (input)" "Work (input)" the amount can not be set.

Enter the amount you want to deduct on each screen on each occasion.

You can delete it by clicking the trash can icon. ↑ ↓ You can swap the order by dragging while clicking the icon. - It appears in the deduction master list.

.png)

The deduction items registered here can be selected on the allowance deduction tab of the working condition.

This is all for registering deduction template.